By Lloyd Graff

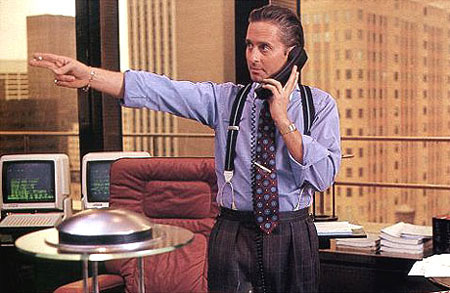

The hot movie at the Cannes Film festival is Wall Street: Money Never Sleeps, the sequel to Oliver Stone’s Wall Street (1987). Michael Douglas plays Gordon Gekko again, who returns to the Street after spending eight years in prison. Art imitates reality. Reality imitates art.

I just finished Michael Lewis’ brilliant new book, The Big Short: Inside the Doomsday Machine, about the appalling fraud among the big shooters on the Street during the subprime fiasco. He could have used the same title he used for his last best seller, The Blind Side: Evolution of a Game, because the duplicity and stupidity of the bond packagers and the rating agencies who blind-sided the government regulators and most investors.

In my callow youth I thought Wall Street banks were conservative stewards of investor money. The Big Short exposed them as crooked, dumb, cynical, casino operators who lacked the scrutiny of Las Vegas.

I think the civil suit against Goldman Sachs was a preliminary probe by the SEC. Goldman’s management probably saw it as a political stunt to help the Obama 2010 Congressional election effort. But Lloyd Blankfein’s poor showing in Washington seems to have emboldened the Feds and New York’s Attorney General, Andrew Cuomo, to keep the pressure on. I’m sure Obama and Cuomo have read Lewis’ book, which lays out the derivative conspiracy with dramatic clarity. The big players—Morgan Stanley, Bank of America (Merrill Lynch), Bear Stearns, UBS, Goldman, AIG—are the names under scrutiny.

I really think we are going to see criminal indictments and “show trials” down the road. Lewis’ number one bestseller lays out the trail like dropped breadcrumbs.

There will be a few Gordon Gekko’s headed to the penitentiary this time around, but unless we shut down the taxpayer funded Wall Street casino, it will all happen again in a few years.

Question: Would you want your son or daughter to work on Wall Street?

1 Comment

Would I want my son or daughter to work on Wall Street? You’re damn right I would. Credit, risk, and finance drives growth. Hedging with derivatives (that dirty word) is widely and needfully practiced by ordinary businesspeople, in all sorts of commodities, both tangible and intangible.

There’s no law against stupidity, even if “the smartest guy in the room” is guilty of it. These were self-styled sophisticated investors, who are supposed to know what they’re doing, alert to all the pitfalls of a particular investment. If they bet wrong, they lose. If they lack scrutiny and the whole loose credit house of cards falls, we lose with them. But it’s nauseating that the elected officials, like Levin, Frank and Dodd, who failed in their duty to scrutinize, are callng for the blood of Goldman Sachs. No surprise, given that they were relentless advocates for Fannie and Freddie to make more money available for cheap and easy mortgage money. Sure, they thought they were just doing their best to help the good people of America to experience the dream of homeownership. It also didn’t hurt that it made them look good in the eyes of their voters. Never mind that many, many people couldn’t afford those houses, or that still many others were in it for the quick profit on the flip. Yet another example of govenmental good intentions gone horribly wrong. Take heed!

Your use of the term “show trial” for the likes of Goldman Sachs is particularly apt. It’s all kabuki-style political theatre, reserved for when the TV cameras are running or the usefully idiotic reporters are scribbling. If you think this Congress, or any Congress, is going to write laws that will prevent the next financial panic, you’re dreaming. Everybody (including individual homeowners) will always want to get in on the next quick profit idea, and every politician will always want to be a hero and pass out the goodies. But when it inevitably blows up, they will all start looking for a way to satiate the baying voters, snarling and bullying and threatening and hysterically pointing the finger of blame at somebody, anybody, else.