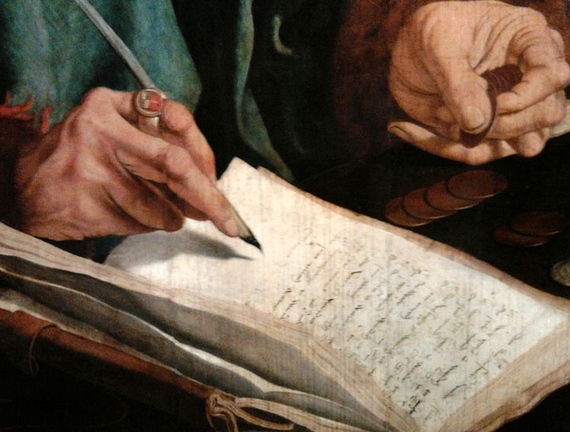

A brief history of where your money goes and why.

The appropriate thing to say about taxes on April 15 is that they’re absolutely terrible. And yes, sure, they are, in a way. Filling out taxes is miserable (especially considering the IRS could probably do it all for you), watching money leave your bank account stinks, and seeing the difference between your adjusted gross income and your take-home pay is depressing.

But perhaps more than any other law, taxes are a keen reflection of what we value as a country. You know what you’re paying this year. Here’s some information about where your money’s going—and where it would go if you lived in Spain, or France … or in the U.S. 50 years ago.

Where do our federal taxes go?

Defense and insurance. It might not surprise you that about $1 in every $5 of federal taxes paid goes to defense. But the rest of the budget is overwhelmingly designed to insure the old and poor and provide a safety net. Social Security, Medicare/Medicaid/CHIP, safety net programs, and veterans’ benefits account for nearly two-thirds of the budget (not including interest paid on our debt).

Read the full article at the www.theAtlantic.com.