By Lloyd Graff

Jim Chanos is famous for identifying the Enron scam, shorting the company’s stock and making a fortune. He runs a hedge fund named Kynikos Associates, which means cynic in Greek. He specializes in spotting emperors without clothes and is currently betting big that the Empire of China is a naked power.

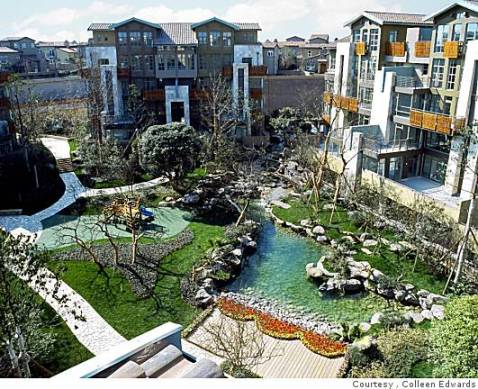

He compares China to Miami and Dubai of recent memory. The common thread is runaway condominium and office construction, huge real estate inflation and a shortage of able buyers. He says that today, all over China, high-rise buildings are rising, fueled by aggressive bank lending to developers. They are building 1,100 square foot shell apartments without floors, and selling them—or attempting to sell them, for around $150,000. The problem is that even though half are going empty, they are still building. With middle class dual earner couples earning an average of $3,500 a year, buying a $150,000 apartment would be the equivalent of an American couple making $40,000 a year buying an $800,000 home. We saw how that worked out in 2007.

Chanos sees the phenomenal growth numbers in China being fueled primarily by real estate speculation and construction. In his view it is unsustainable. State and local governments are being funded by real estate development, so they have an interest in seeing it accelerate. They will suffer mightily when the bubble bursts.

Chanos feels the problem in China is that the central planners set a growth goal, say nine percent, and then tell the underlings to make sure it happens. The easiest way to do it, other than fudge the numbers (which they may do), is to let the builders build with easy money.

What happens if Chanos is right and the giant cranes go away like they did in Dubai and Miami? He feels that the raw materials companies who are supplying the steel, copper and cement will suffer immediately. Copper at $3.60 a pound could plummet, as well as iron ore and scrap prices. Crane companies will get killed. He feels that the Chinese currency, which everybody including the Obama administration is hoping will rise when it is no longer pegged—will fall. Incidentally, Gary Schilling, the noted bearish economist who predicted the American stock market collapse (not the rebound, however) also feels the Yuan will fall in value when it is allowed to float.

Jim Chanos is a very smart guy. He sees the Chinese bubble bursting later this year or in 2011. The Chinese have enormous reserves in dollars to soften the blow and may tighten credit dramatically soon to try to avert a property crash. China bashers may be happy to see the country suffer and revel in lower raw material prices, but with an interconnected world, be careful what you hope for.

Question: Do you hope China collapses?

7 Comments

I hope China doesn’t collapse. I’m no economist, but isn’t this common sense?

The US Debt is funded by China – if China collapses, they are going to need more money to recover from the collapse, so they will call in the US Debt that they are owed, driving the US further into debt.

Look at it this way, you mortgaged your house at the bank. If the bank starts to get into financial trouble, they can call your mortgage “due” at any time. What happens when you can’t come up with the balance due? You’re thrown out, and the house is sold.

The problem is, China isn’t going to want any “paper” assets when they call the note due. They are going to want hard assets – gold, land, raw materials. What is our broke-ass government going to give them? And if we refuse to pay our obligations to China, maybe we will get a “bullet in the back of the head and a bill for the bullet?” – Not a pretty picture if that bullet involves ICBM’s…..

Good article. China has a big bubble…yet a lot of growth, too. Something is going to collide there but I hope it is not catastrophic, as we are all interdependent. They will soon understand this concept in ways that may help the U.S. overall.

Jake, I like the bank analogy. Maybe we resent them, maybe fear them, maybe we hate them. But if they go down we go down. And vice versa.

I have no sympathy for China – no more than they have for the US. China has never played by the rules of international trade and never will. Communist nationalists make up their own rules.

I wrote this blog a few days ago and we are already beginning to see the Chinese leadership get a grip on real estate speculation. They have forbidden owning three homes in Hong Kong and are tightening credit for developers. Hopefully Goldman Sachs of China hasn’t corrupted mortgage derivatives in China as they did in the homeland,

But what if the big cranes leave Shanghai and Hong Kong? World scrap prices go down as does iron ore and copper. Australia and Brazil will feel that immediately and Chile and Africa where the big copper mines are. We will see more cheap Chinese steel in North America. Maybe good for our industry but not so good for Nucor or Mittal.

I think we should hope for a gradual cooling in China. And we know from rude experience that rarely works.

No, I do not wish to see the China economy collapse. As always, it would be the little people who would be hurting. The government would do the ‘cleansing’ to appease the masses and all would be well again.

I see the real problem as one in which there is no longer a ‘Hard Currency’ as a standard in the world economy. This allows all kinds of mischief by the financial world because there is no final reckoning to keep them honest. Each country sets a very loose regulatory system which allows their financial market the latitude to manipulate for profit. Because each country has a different system, all to allow for profit with minimal interference, the dollar, franc, pound or yuan has little or no ‘value’ because there is no base (such as gold) to tie it to.

I have no use for a ‘World Economy’ but until the ‘Dumbmasses’ (I’m one) of each country reach somewhat of parity in wages, there will be the manipulation by governments and financial institutions in a feeble attempt to keep stability.

And when a miscreant with an A-bomb blows up a port, harbor or world capitol, all bets are off.

Gordon, thanks for sharing your insight regarding the issue of Chinese not renting out.

As for me, I do not want China to fail. Our global economy is already so fragile this would be the straw the broke the camel’s back.