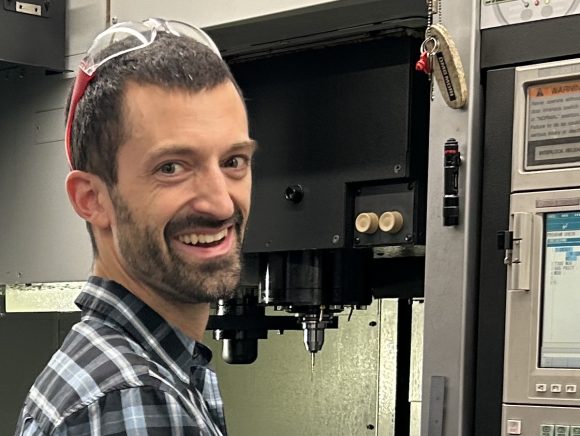

Learning, Teaching, Owning, with Federico Veneziano-EP 259

At 12, he was cutting metal in northern Italy. By 21, he was teaching DMG’s own technicians how to use their machines. At 47, he owns the whole company he first walked into just to set up a machine. Federico Veneziano is the owner of BoldX Industries and an old

Happy Birthday Noah

Today is my son Noah’s 46th birthday. My gift to him and to myself is to write a piece about him and my feelings for

Making Engineers Love Manufacturing, With Andrew Schiller-EP 258

What happens when a mechanical engineering instructor actually comes from industry—not academia? My guest on today’s podcast is Andrew Schiller from Utah Tech, who spent

A Sign to Control My Cubs News

I want to make a big change in my life. It sounds like a minor issue, but I’ve been reading A LOT of sports on

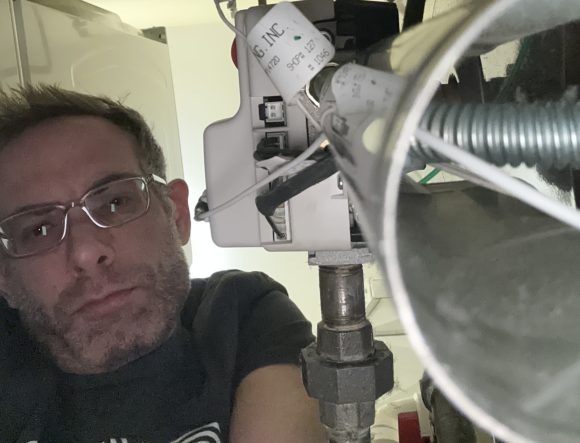

Was I Meant to Do It Myself?

Last week our condo’s hot water heater stopped working. The blue light had three flashes and then eight flashes, which ChatGPT diagnosed as a bad

Running a CNC Swiss Medical Shop, with Shawn Gaskin–Ep. 161

Our guest on the podcast today is Shawn Gaskin, owner of Swiss Technologies of New England and Stone Medical in Plainville, Massachusetts. Shawn started Swiss

Who Needs Your Grandmother’s Silver

Remember your mother’s or grandmother’s silver service for 12 that she only used once or twice a year when the whole family showed up? Remember