By Lloyd Graff.

By Lloyd Graff.

Conventional wisdom says that if you pour money into the American economy it causes inflation.

I am really wondering if this “wisdom” is economists replaying a scenario in their minds that is now obsolete in the silicon age. The theory of scarcity of raw materials, scarcity of housing, scarcity of talent, scarcity of bananas or Berettas is proving to be flawed.

The general trend for most prices in the economy is steady to down. In the world I live in, price increases are always challenged. CNC machines have improved and decreased in price. Hourly rates have stagnated, and total labor costs per unit have trended down.

People speculated on coal but got blindsided by expanding domestic natural gas. Corn peaked at $8 a barrel and now it is at $4.70. Housing prices are supposedly edging up, but I do not see it. So much supply is waiting in the wings it is hard to imagine a surge. Homes are selling because people will now accept lower selling prices. It costs less to make comparable sweatshirts in South Carolina than India according to a recent featured New York Times article.

The theory of endless inflation was a Malthusian myth. In an age of minimal population growth in many countries, the real scarcity is in people.

China, or the next China, still keeps a lid on the price of manufactured goods. Technology may allow us to manufacture food in the next decade, so the bump in farmland prices may be temporary.

We get swings in popularity. Two decades ago, suburban land was hot. Today, cities are more desirable and suburban properties can go begging. If there is price appreciation in property it is local.

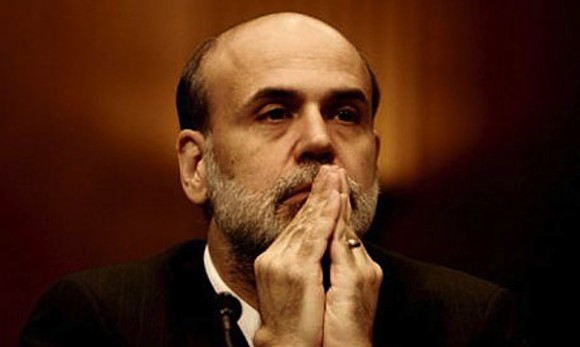

I think Ben Bernanke has been a brilliant Fed Chairman in pouring dollars into the economy. Certainly savers have been hurt, but we have had barely any inflation and we avoided a depression. May his successor enjoy such success.

Question: Are you more afraid of inflation or deflation in the American economy?

Lloyd Graff is Owner and Chief Space Filler at Today’s Machining World and Graff-Pinkert & Co.

27 Comments

Come on, you’re not really wondering that are you? The FED is creating $85B/month from nothing…AKA Currency Devaluation, which INEVITABLY will lead to Hyper-inflation. Maybe not today, but sooner than later. Part of the current cost of Crude Oil is that currency devaluation because oil is traded in US Dollars. The only reason we’ve been able to get away with this is because is because we’re the US and the FED (remember the FED isn’t the US Government) is “buying” bonds with money they don’t have. It’s a House of Cards and when it falls, it won’t be pretty.

I agree with Dan . . . Deficit spending by politicians won’t solve anything long-term. You story sound like whitewashing a rotten wooden fence (the Rott still exists, but what a nice coat of paint)…

C. Elton

Only a liberal democrat could say that there is no inflation in the midst of $85 billion of QE every month. Gone out to dinner lately? Bought a hotel room in the Loop? An airplane ticket? Flour? Sugar?

We’ll be lucky if by the time Obama gets through with this economy we won’t need a wheelbarrow full of hundred dollar bills to buy a loaf of bread.

A friend of mine put it this way: “The problem with QE is this: the more QE persists, the more it has to be unwound. The market irrationally reacts to continued QE as “positive” since it enforces low or zero interest rates. This is because low interest rates are supposed to stimulate growth – or at least the opposite: rising interest rates will slow growth. The operating theory behind QE is that artificially stimulated growth will finally take root such that it has its own virtuous momentum in excess of that driven purely by the low interest rate policy. The reality is that our average GDP growth for the last three years with – unprecedented monetary intervention -is .96%. Without the zero interest rate policy AND the Fed expanding their balance sheet by being the buyer of last resort of US government debt (to the tune of $85 billion/month), we’d probably be mired in an outright depression. So given that the only GDP growth is being created by the government by its act of printing money, we are just increasing the leverage that is now seen as unsustainable to keep short term ( and wan) growth going at the expense of probably massive inflation down the road as other global buyers, understanding that we are overleveraged, demand significantly higher coupon rates on US govt debt in order to step in and replace the Fed as the buyer of Treasury bonds.

In fact, the market should have sold off on Bernanke’ s inexplicable (well, not really – Obama undoubtedly ordered him not to take any action on tapering) weasel on doing what he knows he must do. Given that the market had already done his work for him by backing the ten year up 100 basis points, he already had a certain amount of tapering bought and paid for and had he followed through on a moderate start the reaction would have been that the future economic indicators must be robust enough to convince the Fed chairman that tapering could begin (they are clearly not that robust) . Instead, the market cheered for more government cheese and said, in effect: “we’ll worry about next year after December 31…”

Lloyd,

I live in Ohio and we sell corn here by the bushel not the barrel. I will buy all the barrels of corn you have at $ 8 a barrel.

Go price a new car or go buy a cart full of groceries and see if you think the price of things are holding steady to down.

Not much inflation because the rank & file have little to spend on anything outside of food, housing & transportation. Looks to me like all of Bernekes QE is going into Wall Street to prop up the DOW. That money never gets any further. And right now I’m seeing reports of a contraction in manufacturing.

Lloyd, as the previous posts cover the subject pretty well, I will only add this. You wish Bernanke’s successor the same success. Well you couldn’t be farther off the mark, since the successor will inherit a huge problem that can no longer be fixed. When fiat money crashes, it will be monumental.

Has the Midwest joined OPEC, corn is no longer traded by the the bushel? Wouldn’t surprise me, ethanol fumes must be getting to them.

You were very daring Lloyd to bring this topic up. If you are an Obama hater and a Bush fan, no amount of history will matter in this argument. Everyone, though, is a little right and a little wrong.

Productivity is driving prices down. Depressed wages are hurting demand. Speculators are driving oil and commodity prices up. We can all rightfully despise Wall Street.

Obama has been a great centralist (not a socialist) and with Bernanke they saved us from a worldwide depression, even if some of the spending was not correctly targeted.

What’s needed next is integrity in banking, trading and in how politics is funded. Achieving that will create great wealth again.

When someone gets something for nothing, someone else gets nothing for something.

If printing money was a virtuous way of building an economy, why can’t all of us do it at home?

Amen

From Wikipedia: During the height of inflation from 2008 to 2009, it was difficult to measure Zimbabwe’s hyperinflation because the government of Zimbabwe stopped filing official inflation statistics.[1] However, Zimbabwe’s peak month of inflation is estimated at 6.5 sextillion percent in mid-November 2008.[1]

Seriously! Um, look at the price of gold and silver. Check out what the real unemployment level is, 44% of American’s are not even looking for work! Look at what the stock marked is doing, a barrel of oil was just at 108/barrel! OBUMBLER CARE is going to wreak havoc and the idiot in charge continues to go from problem to problem with solving nothing and ticking everyone off, left and right alike. I think instead of looking at this where the pricing is today, you should ask, if we didn’t have unemployment problems do to horrible handling of the debt crisis which is worse then ever before, um caused by Billy Clinton wanting 8 million new homes and Dodd and Franks giving him the program for the poor that bankrupted most of the world darn near, you should be saying we shouldn’t be doing QE#19 cash infusion because people should be working! The correlation in economics is between interest rates and employment-ultimately, there IS A REASON this is the worst working economy in the history of the United States, and you’re saying they are doing a good job, that’s really disheartening coming from a business owner. You’re wrong on this one, BIG TIME…

Agreed!

Forgot the last line, All Hail Bernanke?—HELL NO…

Ha! The article sounds like those who stated that housing prices would only go up until they didn’t. Inflation is based upon both the amount of money and the velocity of money. Right now the velocity is extremely low. The amount of money being created is increasing by larger amounts than ever before. Once the velocity increases inflation will surely accelerate. It is not a question if if, but when. For those of us who lived through the late 1970s interest rates were low, until they weren’t and when they increased it all happened rather quickly and by a large amount.

The US is leveraging the fact that the dollar is the world’s reserve currency. Cost of petroleum based energy has went up %100 in the last five years and not only here but around the world. That is also why food is more expensive. It costs more to drive a mile. It costs more to grow food. Costs more to mine & manufacture materials. It costs more to make & ship things especially abroad.

Our health care is about to jump up. People are losing their private healthcare to Obama care. Government employees and unions do not want Obama care. Our insurance is going up because of Dodd-Frank regulations. And the folks who did the right thing and saved money got punished for being good and honest.

Lloyd in the used machinery business you don’t need to manufacture anything right? And when the market went down you bought low? And now manufacturing is pretty busy so you are selling high I assume? Selling must be good?

Tell me, are we going to lose our reserve currency status before QE ends? You may think that is a B.S. question right? I will help all who reads this out a little…… when the QE ends – is when US can afford to pay our debt service to other nations (unless we get inflation or deflation). Bernanke could not pull QE plug because we do not have a healthy enough economy for our government to raise more revenue/taxes so we can pay off our debt along with a possible interest rate increase.…….. It’s not about jobs……. It’s about interest/taxes/debt……

Our dear leader Obama and his merry ‘dems is a hoodwinking everyone by not acknowledging that the US government needs to reduce mandatory spending as we “our nation” are accelerating into debt faster than our economy is rising out of it. And the redubs still have not figured out how to explain that we all should pay same percentage in tax. Yup, the sequester has reduced short term debt from discretionary spending reductions…….temporarily.

Well Lloyd, Bernanke had his rose colored glasses on when he too thought the economy was doing better. I predict that the price of oil – continuing to rise at a faster rate than the world increases consumption. Why? How else can governments (politicians) take cover for raising revenue/taxes while blaming private enterprise & the economy & the greedy rich?

So back to where all this began – things are getting cheaper right? And as long as you do not have to make anything for a living what’s the difference eh?

Lloyd for this old dinosaur could you write an article about utopia where there is no accounting of debt, fossil fuels and moral values?

I know that we have talked about this over the years and to date you have been right and I have been wrong. However, I do not think that the Fed has done this for us. They have done it for the government. Let’s say you are deeply in debt and still spending beyond your means, If that was the case you would know that as you continue to borrow, your interest rates are going to go up. That would be bad. So finding a source that can print money and fund my debt purchases is wonderful. It keeps your interest rates down. That is good.

However, I do not think that the carnage is going to begin when the interest rates soar. I think that it is starting now. The government continues to overspend, because the pain has been lessened, This has weakened us in the eyes of the world. The elderly with savings, now see their buying power continually reduced and their savings no longer grow, perhaps even decline. You and I and everyone else with money has no place to go. Stocks are over inflated and the bubble could pop, bonds have no return and will get killed if inflation heats, commodities are too volition, especially for our age, maybe buy land and machines. The economy sputters, because people can live off the printed money and not have to work. These are just a few of the consequences of the government easing their burden, we all get hurt.

OK, you guys caught me on the “barrel of corn”. The reference to ethanol was clever. Touchee.

But I stand by the piece and I challenge you to consider that the possibility of deflation may still be the bigger threat to us all, and Ben Bernanke’s lifelong obsession with The Great Depression motivates his actions not some political obedience to the Great Menace, Obama.

I’M STILL WONDERING WHY INTEREST RATES WERE 21 1/2% IN 1982 PLUS 2 MORE % IF YOU HAD A LINE OF CREDIT.

Lloyd your point of view falls way short of reality, our costs, taxes & regulation burdens are now on the rise so we have to look at ways to reduce cost before we can afford to grow the top line to add enough private sector jobs………..

How can the small business economy expand when costs are held artificially high are rising faster than demand?

Bernanke has his hands tied by the inactions of politicians from the ruling class who are in denial & desperately trying to keep the overspending government from having a spending correction – as always the burden is on the backs of the private employed tax paying citizens who do not take more from the government than they pay in…….

Supply and demand. If you have too many tomatoes to sell, what happens to price(value). The price drops. We have printed too much money and still are, what happens to the value(price) of money, it goes down. Stocks, gold have a value, because money is worth less it takes more money to buy these things. The government is paid by taxes. The purchasing power is decreasing, 44% of Americans are not working or looking for work who should be supporting the tax bill. As they run out of money they become a bigger burden to the system. Obama thinks they will contribute to health care, news flash Lloyd, the poor don’t have any money! With government spending at it’s highest along with debt service at it’s highest the government needs more money, so they are printing it. What happened to farmers when they borrowed there way to prosperity, they went bankrupt. So inflation or deflation, yes! Your getting both! You have inflation and it will continue, but you have seen deflation already, housing, but that’s coming back in a big way in more areas, less people working and less people can afford what they have, then it goes to market to sell, who’s gonna buy it? Shelter, food, and water will be the priority. Now you know why Margaret Thatcher said socialism is great until the money runs out! Hail Bernanke?, Hell NO!

I just read the article and all the above commentary. Some of it twice. For a guy who’s obviously quite intelligent, apparently well aware of what’s going on in the world, nation, and, of all places, Chicago, it amazes me how you can continue to beat the drum for the statistics and philosophy most of the rest of us don’t see, recognize,or understand. What the hell are you reading and watching? I’m sure it’s not Huckabee or Kudlow. Or Judge Jannine Pirot. (Spelling probably incorrect.)

You’re a wonder, but I do enjoy reading you, and Noah, and the comments. Thanx!

Sad to hear you claim there’s no inflation Lloyd but, as always, I do admire your optimism. I suppose this is because the media will do no real reporting on such things as long as Obama is in place. I went by several gas stations this morning; regular gas is $3.46 a gallon, pretty sad that in today’s world we see this as a break in fuel prices. I think somehow these things don’t count as “inflation”. However, that’s far more than I was paying a few years ago. Have you ever gone to the store and bought groceries? The prices have indeed gone up quite a bit. But this may not count as inflation. My wife and I just went out to buy a new bed and box-spring; ours was 10 years old and not quite as comfy as it once was. Boy, have the price went up on them! That is probably not inflation either. What has really stagnated, as you somewhat point out is wages and while the price of everything I need from fuel, food and healthcare go way up, my wages don’t. But again, that is not “inflation”. With a little luck the liberals won’t have to hear anything about inflation until after the Obama disaster, unless it gets so bad the media can’t ignore it. It will be an immediate story if a Republican candidate wins in the next presidential election.!

In simple terms if they use QE to get to get economy going when it is down and there is at least one recession every decade and we never stopped QE from the last recession what tool will we use for the next recession? I bet we double down, prices are up and instability is more likely as more of our economy is based on non-essentials.

Here is some very recent commentary from the economist who predicted faults with Greenspan and predicted failure, and he see huge issues ahead. Raghuram Rajan said in TEA LEAVES by Manual Hinds, 9/22/2013.

“Now Rajan has issued another warning by increasing the benchmark rate in India, shortly after the US Federal Reserve decided to keep on buying $85 billion of securities per month under its quantitative easing 3 program, to the general happiness of financial sector managers and traders. The Fed’s announcement spurred an immediate mini-boom in all financial instruments. The day after the announcement, I published an article in Quartz in which I argued that the current high rate of monetary creation and the extremely low interest rates caused by QE3 are unsustainable and that, sooner than later, interest rates are bound to increase. I argued further that the long prevalence of extremely low interest rates is likely to be creating the conditions for a serious financial crisis; all the economic activities that are profitable due to low rates will become unprofitable and will not be able to repay their obligations.

For this reason, it is necessary to prepare for such eventuality. This is what Rajan is doing by increasing interest rates in India, by easing the appetite for unsustainable activities that can survive only with low rates. The Financial Times quotes his rationale: “Let us remember that postponement of tapering is only that—a postponement…Let’s not lose the chance, the warning that we have been given, because this is going to come back and what we need to do is put our house in order before.”

Well Lloyd, even the world knows we overcooked the books with printing money…

Hail Bernanke, HELL NO!

HI LLyod,

It is certainly an unfortunate state of affairs when a business owner in the rust belt thinks things are OK. QE is just another tatic to destroy the strength of America. The progsocialists are screaming bloody terror that cutting $4B/yr in food stamps to people who are able bodied with not children is going to starve millions to death. How about pull 0.5% of the annual QE money and fund the $4B deficit in food stamps? The gov’t spending has now and forever lowered the standard of living in America, socialized medecine will be the last coffin nail. The unfunded debt liability is $100-$200 TRILLION, it is so big they can’t even get an accurate number on it. Our great grandchildren whill never hope to be solvent unless we elminate baseline budgeting, gov’t waste and entitlements. I am from Rockford, we have 20% un-employment, we are in a depression and bailing water into the boat as fast as we can. Gas has doubled since obummer took office, eggs have tripled, on and on, plenty of inflation. The other trick is companies are making food portions smaller and holding price points, that is inflation too.

Pardon my spelling mistakes, my keyboard is worn out and obama won’t give me a new one because I work for a living. 🙂